3 Questions to consider before purchasing a CD

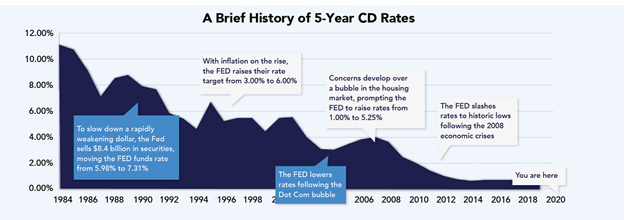

Since 1984, 5-year CD rates have trickled down from their peak of nearly 12% APY* to a low today of 1.14% and trending lower due to record low treasury yields.

With volatility in the markets at an all-time high, individuals are looking for safe options to allocate their portfolio into whether it be bonds, CDs, or money market funds. Money markets have seen a large uptick of inflows. This year we have seen money market funds grow to $4.5 trillion in assets. In March alone, the U.S. Money Market Funds experienced nearly $1 trillion of new money entering into money markets.** The downside of being in cash right now is low yields make it difficult for accounts to keep pace with inflation.

There are principally protected options that provide potential higher returns than both money market accounts and bank CDs. Below are three questions that need to be addressed before making the decision to purchase a CD.

1. WHEN WILL CD RATES MOVE HIGHER?

This is the million-dollar question in the investment world today. As the chart above shows, we still have not seen a meaningful increase in interest rates for nearly a decade. Nobody knows for certain, and it is important for investors to understand that there can be a significant cost to waiting for rates to increase before investing.

2. WHAT ALTERNATIVE EXISTS?

Bonds are a natural substitute. The problem, however, is that bonds lose value on the secondary market when interest rates increase. With rates at historic lows, many investors are using Multi-Year Guaranteed Annuities or “MYGAs” as an alternative option.

3. HOW CAN MYGAS BE PART OF A MODERN PORTFOLIO?

Like bank CDs, MYGAs come in a number of durations. While these products have historically been viewed as a “stand alone” part of retirement planning, retirees are starting to use these products as part of a sophisticated portfolio.

Now investors are looking for principal protection to avoid taking losses during these uncertain and volatile times. WealthVest has further tools to help determine if safe money alternatives fit within your plan. For more resources on MYGAs and to work with a WealthVest wholesaler on your MYGA options, fill out the form below.

Bank CDs and Money Market Accounts are insured by the FDIC up to $250,000 for more information visit: https://www.fdic.gov/deposit//deposits/faq.html

MYGAS are issued by insurance companies and are not FDIC insured. Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. Annuities are designed to meet long-term needs of retirement income. Annuity contracts typically require money being left in the annuity for a specified period of time, usually referred to as the surrender charge period. If you fully surrender your annuity contract at any time, guaranteed payments provided for in the contract and/or any rider will typically no longer be in force, and you will receive your contract’s cash surrender value. Early withdraw charges will apply if money is withdrawn during the early withdrawal charge period.

This is not a comprehensive overview of all the relevant features and benefits of either bank CDs or multi year guaranteed annuities. Before making a decision to purchase a particular product, be sure to review all of the material details about the product and discuss the suitability of the product for your financial planning purposes with a qualified financial professional.

Not FDIC insured • May lose value • No bank or credit union guarantee • Not a deposit • Not insured by any federal government