1040 Tax Guide: Locate Assets and Help Your Clients with Tax Deferral

With tax season here, WealthVest has recently released the 2022 1040 Tax Guide to serve as a way for financial professionals to build knowledge on using their client’s tax returns for deeper planning conversations. It will go through individual entry sections on the 1040 form that can reveal information on clients’ financial profiles. It can be used to lessen their tax burden, uncover planning opportunities, and help financial professionals know more about their clients’ investments.

Although the IRS has simplified the form over the past couple of years, this year’s tax guidelines are still complicated and there is still a lot of information that can be gained by understanding the key entry lines, and schedules. The 1040 Tax Guide covers the simplified 1040, and schedules 1, 2, 3, and B, including instructions for the schedules and how they impact retirement planning.

The back of the 1040 form is the most significant part of the guide. It takes a look at earned income on line 1 an important insight to pre-retirees earnings as this may be a target of future income planning needs.

The very next line – 2a and 2b leave a lot of planning windows open. Tax-exempt interest is money from tax-advantaged plans. If the client has money here, then they are currently participating in the benefits of tax-advantaged plans including Municipal bonds, Roth IRAs, Tax-free savings accounts, and life insurance products. There may be better options available to these individuals over what they have invested in municipal bonds.

Taxable interest in line 2b is where this money is coming from and is a point of emphasis for this guide. If the client has $1500 in taxable interest or ordinary dividends, they will have to fill out schedule b. If the financial professional can view this schedule, financial professionals will be able to determine where their client’s money is located. It will show the accounts where they are getting this money from – thus telling the story of how many financial professionals they are working with and what type of investor they are.

Moving on to ordinary and qualified dividends, assets in this line create taxable interest income. Ordinary dividends are a share of a company's profits passed on to the shareholders periodically and are taxed as ordinary income at the highest marginal tax rate.

Qualified dividends are ordinary dividends with a few caveats. First, to be eligible for the qualified dividend rate, the payee must own the stock for a period of time, generally 60 days for common stock and 90 days for preferred stock. Second, to qualify for the qualified dividend rate, the dividend must also be paid by a corporation in the U.S. or with certain ties to the U.S. These are taxed at the lower long-term capital gains tax rate than the higher tax rate for an individual’s ordinary income tax rate. Assets in lines 3a and b could be moved into an annuity to avoid additional taxes for high-income earners.

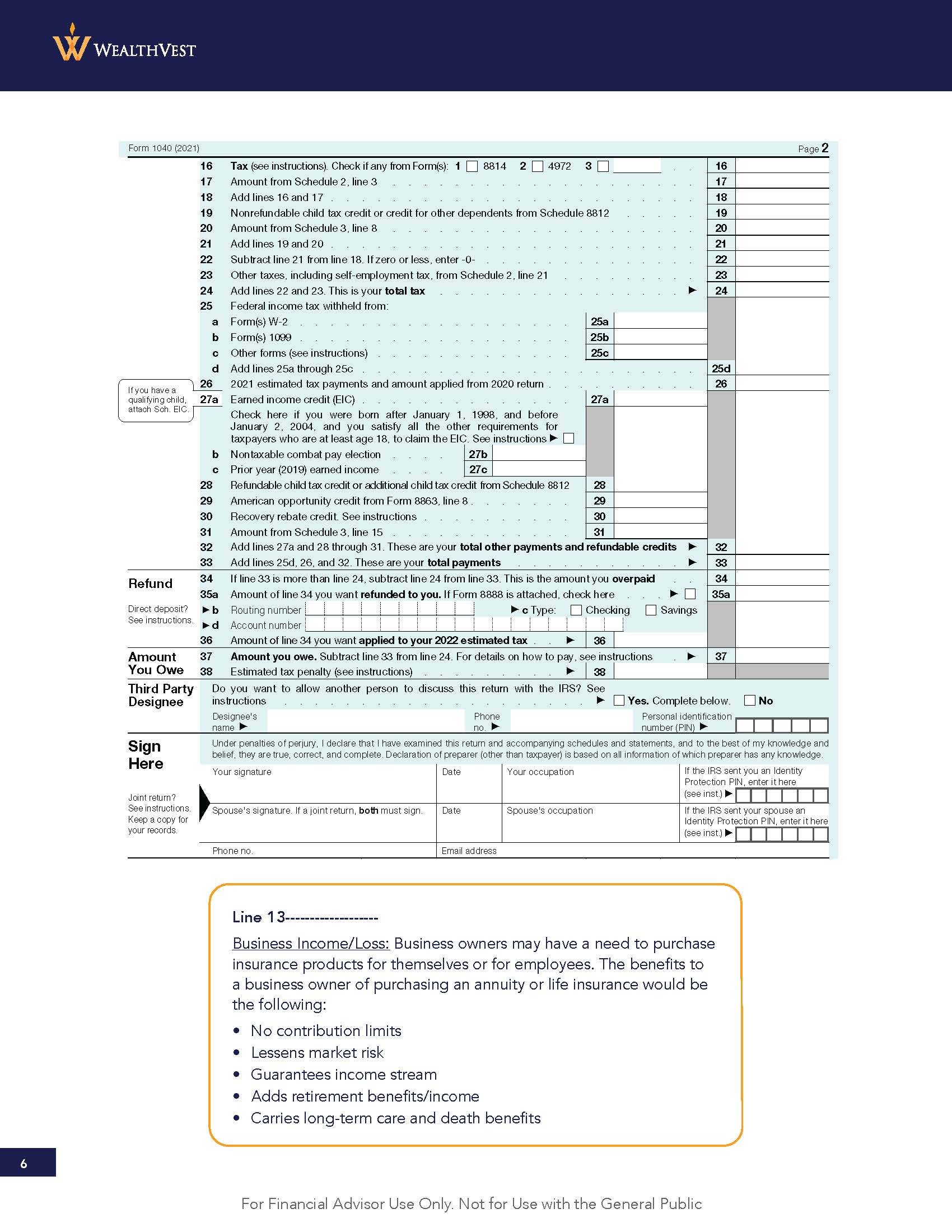

The tax form covers IRA and Annuity/pension distributions, meaning these clients are typically in retirement currently and financial professionals may want to discuss additional planning points associated with retirement or reassess their income strategies. We also highlight business owner needs and a few planning points regarding income from an owned business.

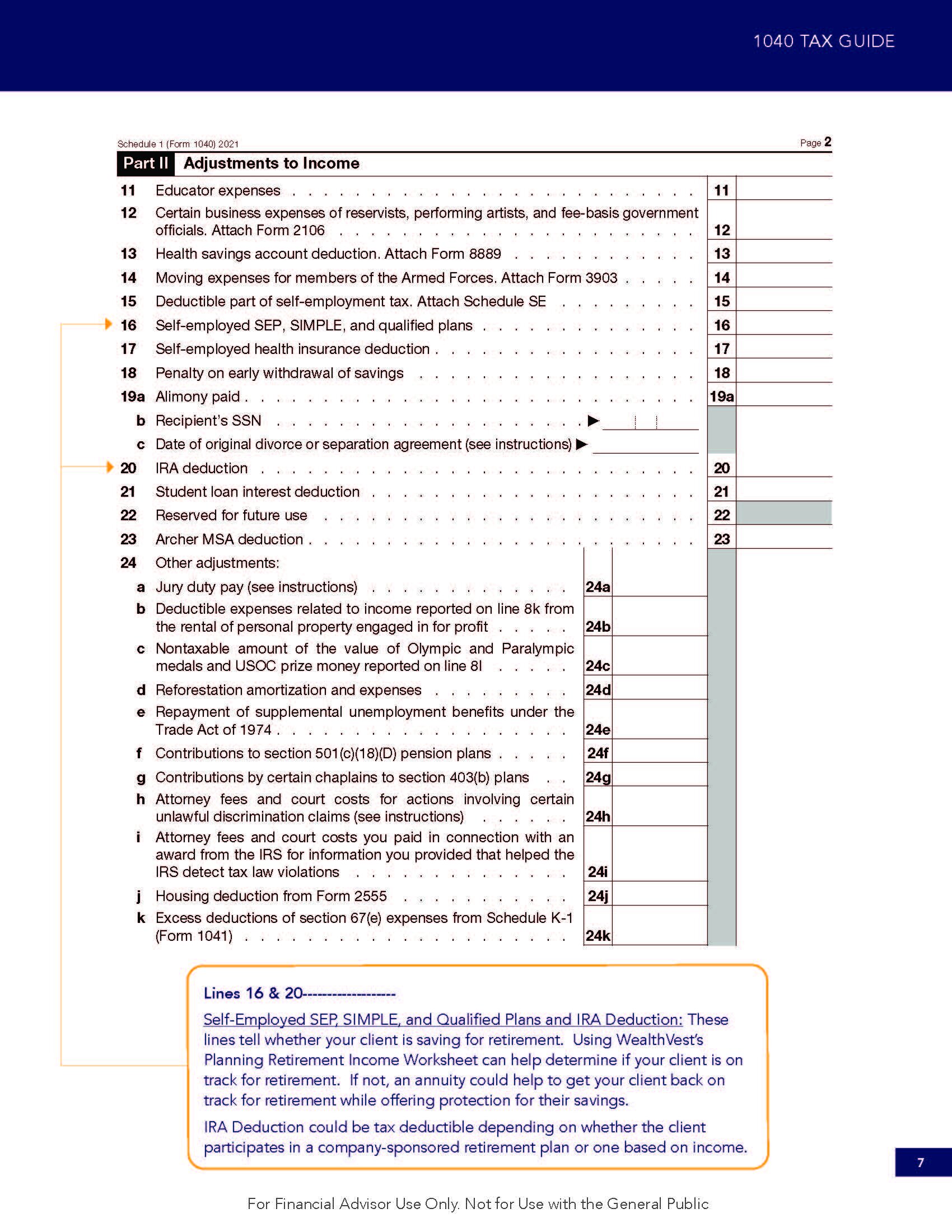

Looking at schedule 1 – the pertinent lines are capital gains/loss and self-employed, SEP, simple, qualified plans, and IRA deduction. Growth of assets on this schedule can bring about an annuity conversation to protect those assets while losses may lead to an additional risk planning conversation. Reviewing retirement accounts and providing our planning retirement tool would be of use for when reviewing lines 16 and 20.

Schedule 2-High earning individuals are limited in the amount they can contribute to qualified plans and are not eligible for a tax credit on these contributions. Annuities are a big talking point for those who cannot contribute since they can generate income in a tax-deferred way for retirement.

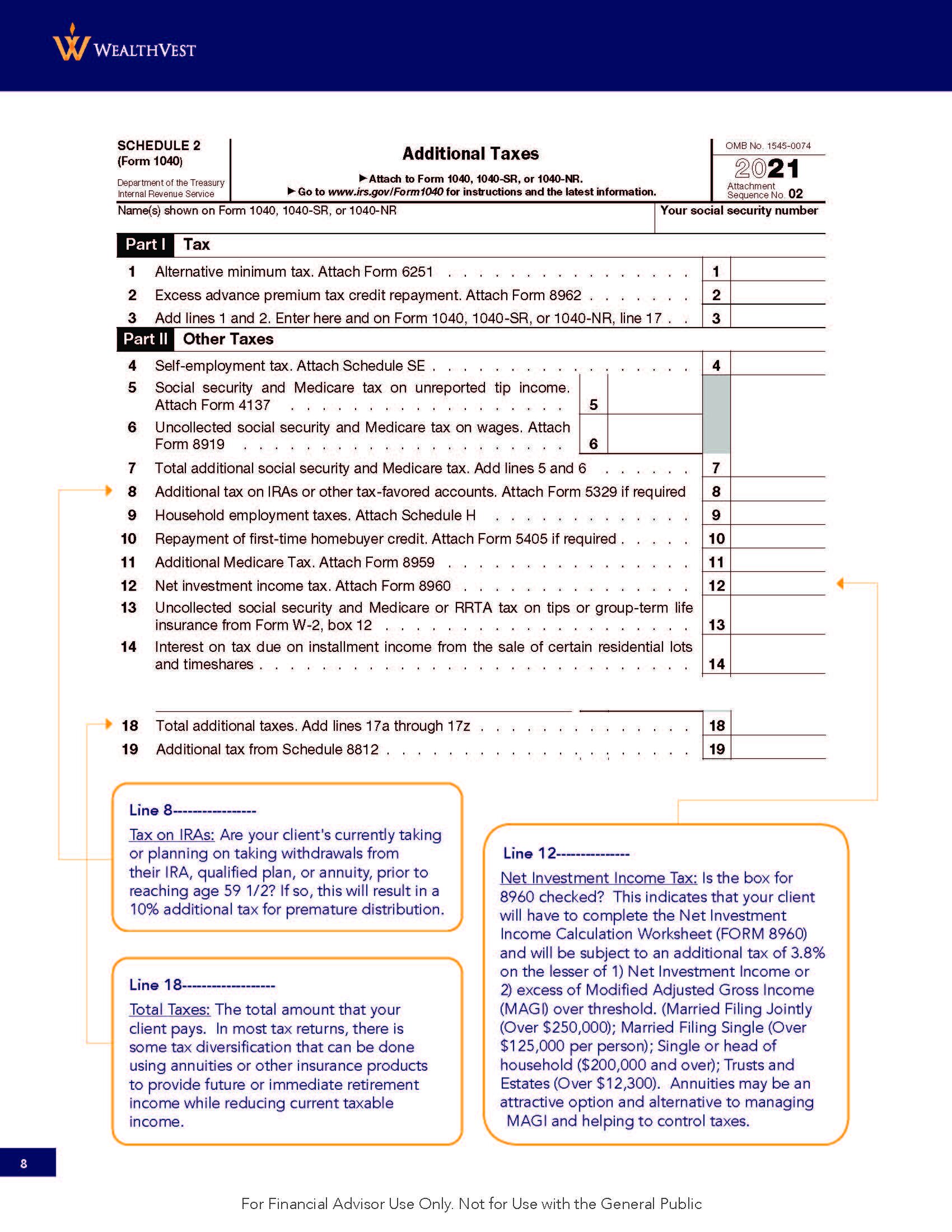

In schedule 2, tax on IRAs, this means the client may be subject to an additional 10% tax if they are taking withdrawals prior to 59 ½. Total tax shows how much the client is paying in total. This number may be able to be decreased with annuities while reducing taxable income. The net investment income tax is a 3.8 percent surtax on a portion of the modified adjusted gross income (MAGI) over certain thresholds. It hits high earners with significant investment income. It might take a bite out of the client’s finances even if they manage to avoid paying significant income taxes on their investment income through the use of deductions, credits, and other tax perks.

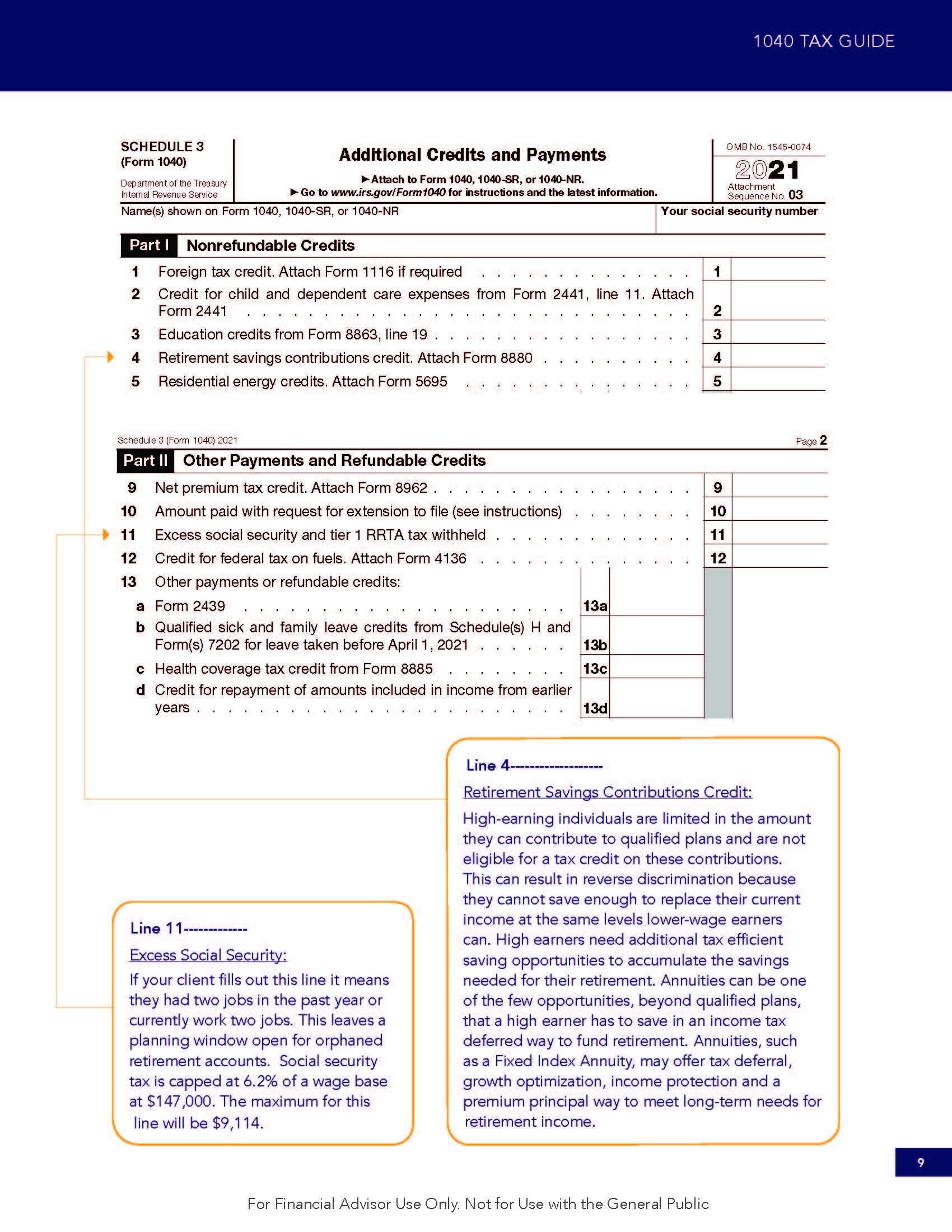

In schedule 3 we look at two separate lines. Line 11 shows excess social security, which is only pertinent if the client has switched jobs. This could lead to a rollover conversation if this is the case. The retirement savings contribution limit highlights how much an individual can contribute to their retirement accounts. High-earning individuals are limited in the amount they can contribute to certain accounts creating a planning gap. These investors will still require a level of tax-efficient planning and an annuity conversation could help close this gap.

Remember this is simply a road map to help financial advisors generate higher value conversations and help to assist clients with future or immediate income needs. Download this sales tool here. To talk to our sales team on how better position this tool with your clients, fill out the form on this link or call us 877.595.9325

The 1040 Tax Guide brochure is designed to provide general information on the subjects covered. Pursuant to IRS Circular 230, it is not, however, intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. Please note that WealthVest, and their representatives and employees do not give legal or tax advice. Encourage your clients to consult with their tax advisor or attorney.

Purchasing an annuity inside a qualified plan (retirement plan) that provides a tax deferral under the Internal Revenue Code provides no additional tax benefits. An annuity used to fund a tax qualified retirement plan should be selected based on features other than tax deferral. All of the annuity’s features risks, limitations and costs should be considered prior to purchasing an annuity inside a qualified retirement plan.

Please note that in order to provide a recommendation to a client about the liquidation of a securities product, including those within an IRA, 401(k), or other retirement plan, to purchase a fixed index annuity or for other similar purposes, you must hold the proper securities registration and be currently affiliated with a broker/dealer or registered investment advisor. It is generally prohibited for insurance-only licensed professionals to review a client's tax return and/or to provide tax advice. If you are unsure whether or not the information you are providing to a client represents general guidance or a specific recommendation to liquidate a security, please contact the individual state securities department in the states in which you conduct business.

This brochure provides general tax information; however, it is not advice; WealthVest does not provide legal, tax, or estate-planning advice. Please encourage your clients to consult with their tax advisor for further questions.

Annuities are designed to meet long-term needs for retirement income. They provide guarantees of premium and credited interest, subject to surrender charges, and a death benefit for beneficiaries.

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not apply to the performance of the index, which will fluctuate with market conditions. Annuities are designed to meet long-term needs of retirement income. Annuity contracts typically require money being left in the annuity for a specified period of time, usually referred to as the surrender charge period. If you fully surrender your annuity contract at any time, guaranteed payments provided for in the contract and/or any rider will typically no longer be in force, and you will receive your contract’s cash surrender value. Early withdraw charges will apply if money is withdrawn during the early withdrawal charge period.

For Financial Professional Use Only. Not For Use With The General Public.