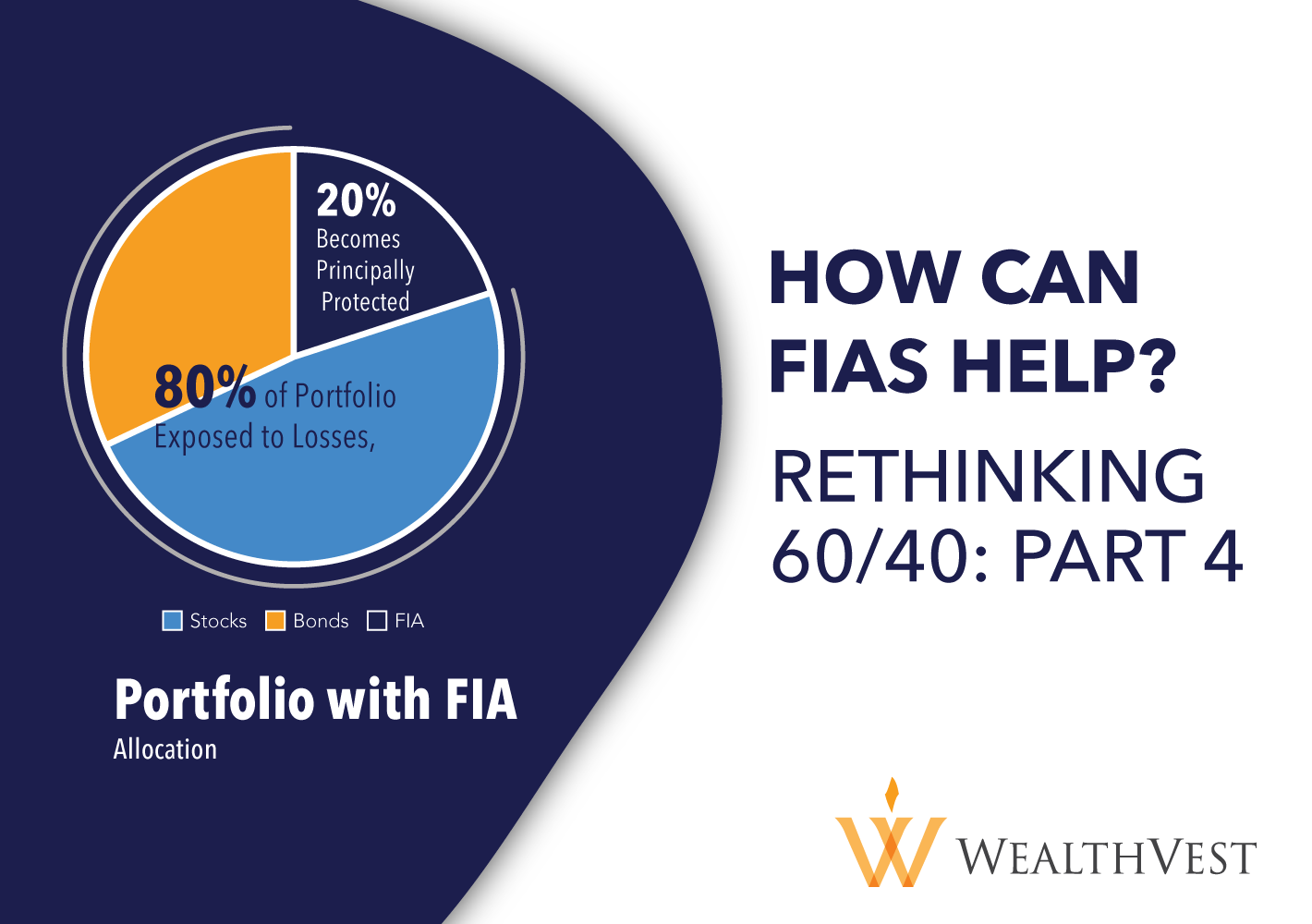

Rethinking 60/40 Part 4: How Fixed Index Annuities Can Help

WealthVest believes that there is a natural fit for FIAs within optimized portfolios A fixed index annuity is a type of fixed annuity that offers a rate of return based on market performance. An FIA is appropriate for someone who is closer to retirement, prefers tax deferral, principal protection, and market participation. While FIAs may not be appropriate for younger individuals with higher risk tolerance or if they need access to their funds immediately. By allocating 20% of a 60/40 portfolio to an FIA, the portfolio’s risk premium decreases due to the guaranteed protection from the annuity.

Rethinking 60/40 Part 3: How Multi-Year Guaranteed Annuities Can Help

WealthVest believes that there is a natural fit for MYGAs within optimized portfolios. A multi-year guaranteed annuity, or MYGA, is a type of fixed annuity that offers a guaranteed fixed interest rate for a certain period, usually from three to ten years. A MYGA is appropriate for someone who is closer to retirement and prefers tax deferral and a guarantee of investment return. By allocating 20% of a 60/40 portfolio to a MYGA, the portfolio’s risk premium decreases thanks to the guaranteed protection from the annuity.

Rethinking 60/40 Part 2: What can we learn about the years when stocks and bonds are both negative?

Rethinking 60/40: What can we learn about the years when stocks and bonds are both negative?

In our last blog post, I discussed the underlying reasons for today’s underperformance of 60/40 portfolios, but let’s look at how much of an anomaly today’s times are and where 2022 falls in history. Since 1928, we can glean the underlying reasons a 60/40 portfolio allocation became popular method for investors seeking reliable returns. The chart below shows historical corporate bond yield and the S&P 500® returns by year, demonstrating how often bonds and stocks remained positive. However, looking at the years in which equities and bonds are negative provides important context for the contemporary market environment.

Rethinking 60/40: Part 1-Why investors use 60/40 allocations?

Rethinking 60/40: Why have individuals used 60/40 Allocations for their Retirement Savings?

A portfolio invested in 60% stocks and 40% bonds, commonly known as a 60/40 portfolio, is where many portfolios start before adjusting to a diversified mix based on time horizon, risk tolerance and savings goals. The 60/40 portfolio mix is a tried and true portfolio allocation because it provides market gains during market rallies and fixed income reliability during economic slowdowns. This portfolio is most suitable when interest rates go down, as equities perform well. When interest rates rise, equity returns typically fall.

Webinar: Tax Efficient Retirement Planning

Join WealthVest's National Sales Manager, Charlie Yoachum, where he will walk through how you can utilize tax season to uncover more of your client's assets, positon tax deferral, and have deeper conversations surrounding retirement savings with your clients.

This webinar will feature WealthVest's 2022 1040 Tax Guide, 2022 Tax Summary, and Taxable Yield Chart. These tools help financial professionals have successful client conversations, and will feature sales ideas you can use in your practice.

1040 Tax Guide: Locate Assets and Help Your Clients with Tax Deferral

With tax season here, WealthVest has recently released the 2022 1040 Tax Guide to serve as a way for financial professionals to build knowledge on using their client’s tax returns for deeper planning conversations. It will go through individual entry sections on the 1040 form that can reveal information on clients’ financial profiles. It can be used to lessen their tax burden, uncover planning opportunities, and help financial professionals know more about their clients’ investments.

THE GREATEST BOND BULL MARKET IS OVER…

When I sat down in early February to reevaluate the piece, What’s Your Favorite Fixed Income Alternative, the 10-year treasury hovered near historic lows, by March, they had plunged further than many expected. March was the most volatile month we’ve seen since the Great Depression, not only in equities, but in bonds too. U.S. sovereign debt has traded at highest highs, with yields dropping to .318% on the 10-year and 1.34% on the 30-year*. Falling interest rates have resulted in gains for bond funds and bonds trading in the secondary market. With bonds trading at record highs, talk to your clients about potential bond alternatives for a few reasons.