All Eyes on Congress and Our Waning Fiscal Credibility

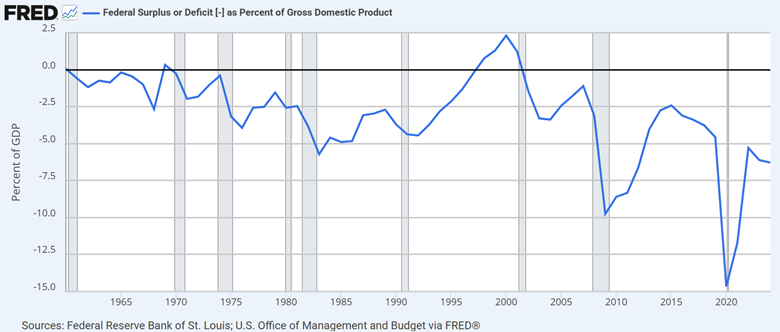

“We expect federal deficits to widen, reaching nearly 9% of GDP by 2035, up from 6.4% in 2024, driven mainly by increased interest payments on debt, rising entitlement spending, and relatively low revenue generation. We anticipate that the federal debt burden will rise to about 134% of GDP by 2035, compared to 98% in 2024.” Moody’s Friday May 16th

Many years ago, when I was an analyst covering consumer stocks, one of my favorite CEO’s was the brilliant but controversial Reuben Mark at Colgate. The beauty of Colgate was (and is) their dominant market share in emerging markets from India to Venezuela. Reuben loved to dramatically recite a fable of a man who approached the castle and manicured grounds of a royal family. The man asked one of the family members how he had managed to create such a perfectly smooth lawn. The reply from the princely resident was, “It’s easy, all you have to do is aerate and roll the grass in the spring and fall every year for 200 years.” His point was that Colgate’s market share was built over many years and no competitor could threaten that share without decades of work and investment.

But it is also true that a beautiful smooth lawn many years in the making can be destroyed far more quickly. The US economy is the castle and grounds of the world’s envy. We have many, if not still most, of the world’s great universities, the greatest global companies from Apple and Microsoft to Coca-Cola and Disney, and the most liquid and most attractive safe-haven capital markets in the world. My guess is that ten years from now, that will all still be true. But as the quote above from Moody’s illustrates, we are losing the ability to responsibly govern our fiscal affairs. It has become impossible for the party in power to sacrifice their collective political future for the sake of lowering deficits below the rate of growth. The key point to understand is that our slide into governmental ineptitude has very real economic and market ramifications.

It is not a coincidence that Moody’s chose now to make their downgrade. All indications are that the current reconciliation bill, in its various bicameral forms, is going to be profoundly deficit additive. While the markets have taken the downgrade in stride, the move will highlight the importance of the pending tax and spending package. All eyes will be on Congress and our waning fiscal credibility.

In 2023, we published a white paper titled “Deficits, Populism and Higher Rates”, which discusses all facets of the risk posed from losing our credibility as a functional Democracy. We analyze gerrymandering, the rise of populism globally, our societal bifurcation along political lines, and the concept that “deficits don’t really matter”.

Please take a few minutes to get a better understanding of the critical intersection of the global economy and the effectiveness of American Democracy.

Tim Pierotti is WealthVest’s Chief Investment Officer.

Tim has over 25 years of experience in various aspects of the equities business. Prior to joining WealthVest, Mr. Pierotti spent seven years in Equity Research management roles at Deutsche Bank and most recently at BMO where he was a Managing Director and Head of US Product Management. Tim has 11 years of investment experience most notably as Head of Consumer Research and Portfolio Manager at The Galleon Group, a former NY based $8Bln Long/Short hedge fund. Tim is a graduate of Boston College and lives in Summit NJ.

WealthVest makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made in this material, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of Tim as of the date indicated. They do not necessarily reflect the views and opinions of WealthVest and are subject to change at any time without notice. WealthVest does not have any responsibility to update this material to account for such changes. There can be no assurance that any trends discussed during this material will continue.

Statements made in this material are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed in this material, including consulting their tax, legal, accounting or other advisors about such information. WealthVest does not act for you and is not responsible for providing you with the protections afforded to its clients. This material does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by WealthVest.

Certain statements made in this material may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

The S&P 500® is a trademark of Standard & Poor’s Financial Services, LLC and its affiliates and for certain fixed index annuity contracts is licensed for use by the insurance company producer, and the related products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC or their affiliates, none of which make any representation regarding the advisability of purchasing such a product. WealthVest is not affiliated with, nor does it have a direct business relationship with Standard & Poors Financial Services, LLC.