Rethinking 60/40 Part 4: How Fixed Index Annuities Can Help

In my previous posts (Part One, Part Two, Part Three) I discussed how adding multi-year guaranteed annuities would help an optimized portfolio but looking deeper at a different option in a fixed index annuity could be an attractive option for clients who want more performance with less guaranteed performance or if they are looking for guaranteed lifetime income.

WealthVest believes that there is a natural fit for FIAs within optimized portfolios. A fixed index annuity is a type of fixed annuity that offers a rate of return based on market performance. An FIA is appropriate for someone who is closer to retirement, prefers tax deferral, principal protection, and market participation. While FIAs may not be appropriate for younger individuals with higher risk tolerance or if they need access to their funds immediately. By allocating 20% of a 60/40 portfolio to an FIA, the portfolio’s risk premium decreases due to the guaranteed protection from the annuity.

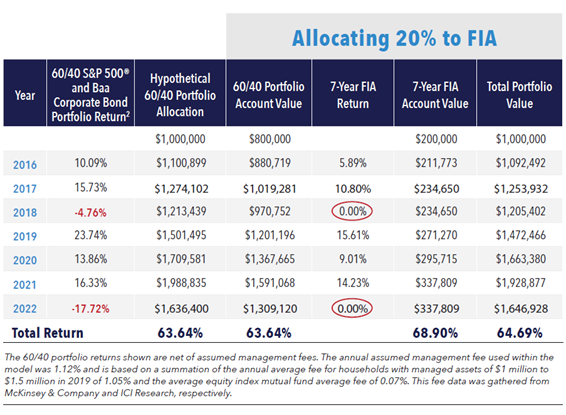

Let us look at how allocating 20% of a hypothetical 60/40 portfolio to a hypothetical 7-Year FIA with a 50% annual point-to-point participation rate on the S&P 500® would have performed over the past 7 years. A participation rate is that when the index it tracks goes up during the crediting period, the FIA’s account value is credited interest based on the performance of the index up to a limit of the participation rate, and when the index goes down during the crediting period, the interest credited is zero and no losses in principal are realized in the FIA’s account value. Demonstrated below, we see a hypothetical $1,000,000 60/40 portfolio performed during this period compared to allocating $200,000 of a portfolio to an FIA and leaving $800,000 allocated to a 60/40 split. The portfolio with the FIA outperforms the 60/40 portfolio during the period by 1.04%. By allocating 20%, or $200,000, to the FIA, with principal protection during market down years and market participation during positive years, the investor can recoup market losses and put themselves in a better position years later. Although this scenario demonstrates how FIAs performed during bull markets, by adding a portion of your assets to an FIA, principal is protected and can ease sequence-of-return risk while providing performance.

FIAs Combine 4 Powerful Concepts:

PRINCIPAL PROTECTION

An insurance company issues FIAs and the guarantees on an FIA are backed by the financial strength and claims-paying ability of the issuing insurance company. Their principal is protected and its value will not decrease below the initial purchase price.

TAX-DEFERRED GROWTH

Careful management of taxes paid on your savings can substantially increase the growth of those savings. Greater savings mean greater retirement income. This is one of the great benefits of individual retirement accounts, 401(k)s, and other retirement vehicles. These vehicles allow you to defer taxes until you need your retirement income. When you defer taxes, you earn interest on money that would have been paid to taxes. This is the power of tax deferral.

In an FIA, the owner only pays taxes when income is taken out, which allows the money to grow in deferral. From the wide variety of financial products, choosing one that allows for tax deferral can be prudent in a retirement portfolio. Tax deferral is often in a client’s best interest. FIAs allow you to defer your taxes until you need the income. An investor’s withdrawals are taxed at an ordinary income rate, which is typically much lower in retirement.

LIFETIME INCOME OPTIONS

By purchasing an FIA, at maturity, there are options to convert the accumulated principal to a guaranteed lifetime income stream for one life or two.

MARKET PARTICIPATION

Although they are fixed insurance products and not designed to compete with the equity markets, FIAs can reference the markets for the potential to offer greater interest credits for fixed income portfolios. With various market indices available, FIAs offer the ability to position portfolios to capture interest linked to the equity market upside without taking on interest rate risk or market loss. An FIA’s contract value is protected when the market is down while delivering gains when the market rebounds.

For more in our series: Rethinking 60/40: read our consumer-approved whitepaper https://www.wealthvest.com/rethinking-60-40-fia or find our newest posts at www.wealthvest.com/wealthvestblog

Are you interested in alternatives to 60/40 allocations? Contact us at 877-595-9325 or reach out to your wholesaler. Don’t know who your wholesaler is? Meet them by filling out the following form.

The 60/40 portfolio returns shown are net of assumed management fees. The annual assumed management fee used within the model was 1.12% and is based on a summation of the annual average fee for households with managed assets of $1 million to $1.5 million in 2019 of 1.05% and the average equity index mutual fund average fee of 0.07%. This fee data was gathered from McKinsey & Company and ICI Research, respectively.