THE GREATEST BOND BULL MARKET IS OVER…

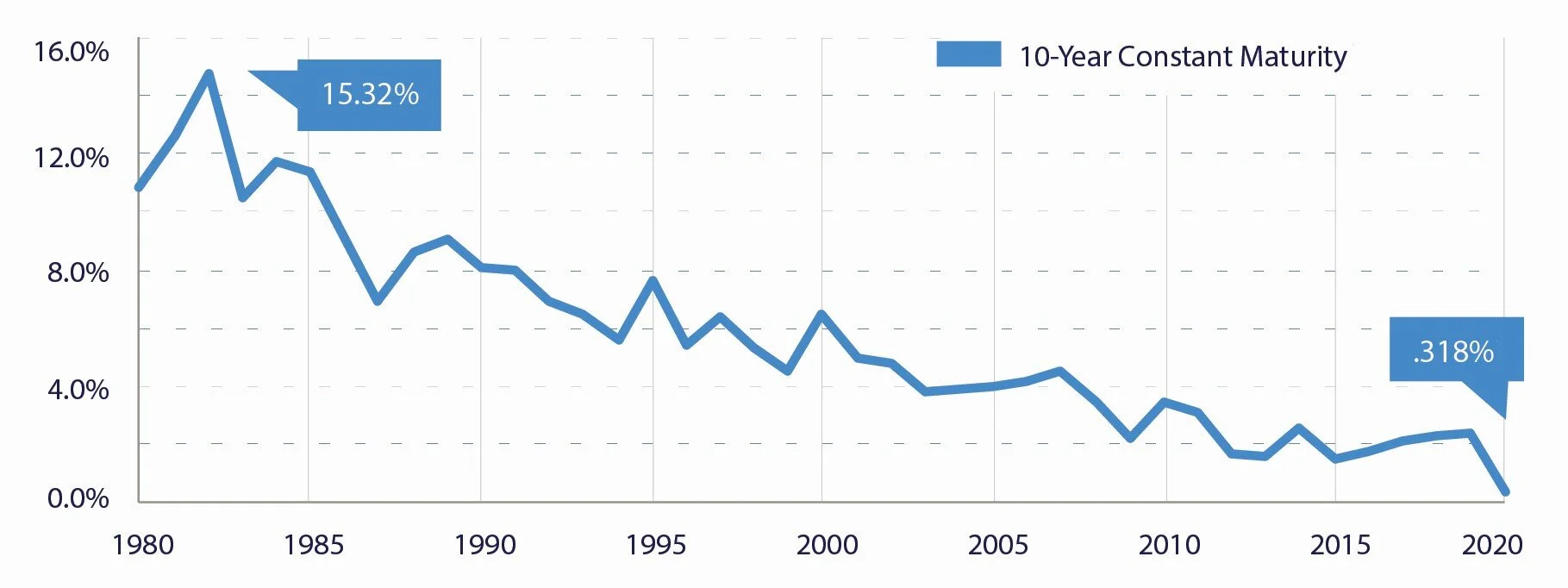

When I sat down in early February to reevaluate the piece, What’s Your Favorite Fixed Income Alternative, the 10-year treasury hovered near historic lows, by March, they had plunged further than many expected. March was the most volatile month we’ve seen since the Great Depression, not only in equities, but in bonds too. U.S. sovereign debt has traded at highest highs, with yields dropping to .318% on the 10-year and 1.34% on the 30-year*. Falling interest rates have resulted in gains for bond funds and bonds trading in the secondary market. With bonds trading at record highs, talk to your clients about potential bond alternatives for a few reasons.

From 1981 to 2020 Investors have experienced the longest bond bull market

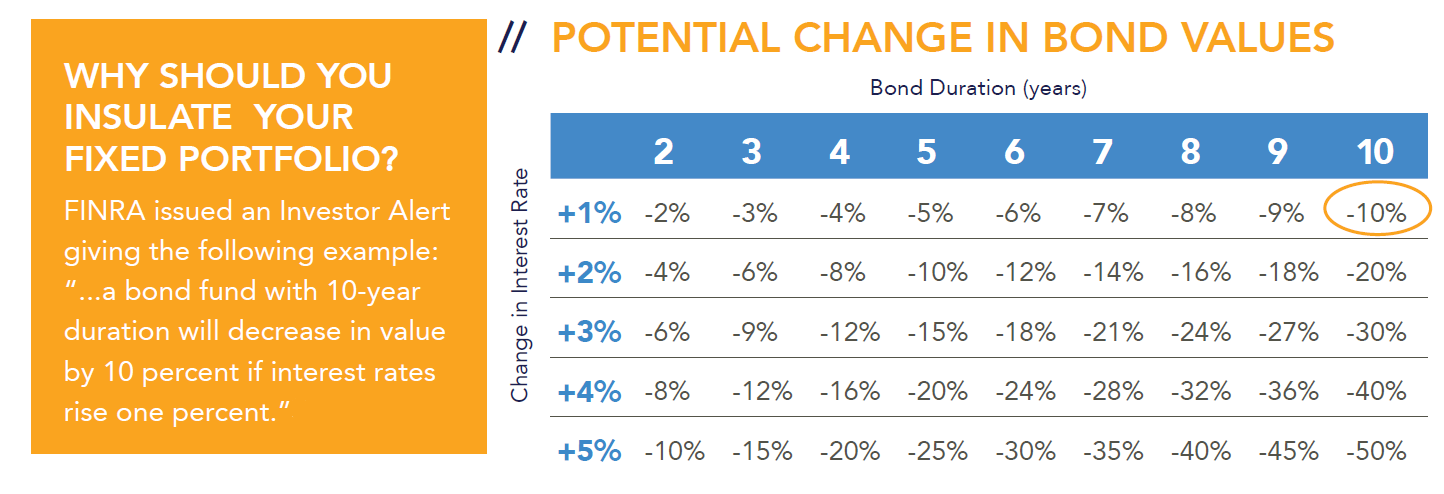

If we do go through an inflationary period due to the increased level of debt offerings by the Federal Reserve, yields would increase, and the subsequent value of bonds would decrease in the secondary market. Changes in interest rates are one of the most significant factors affecting bond values in the secondary market. A truth of bond and bond fund investing is that when interest rates rise, secondary bond market prices fall.

FINRA, Duration - What an Interest Rate Hike Could Do to Your Bond Portfolio http://bit.ly/1ktg1GX

Long term, this is not what bond investors have experienced. Since 1981, the U.S. has been in a bond bull market, where investors experienced consistent and predictable returns from yields and increase in prices of their long-term bonds. A strategy shift would be necessary during a low-interest rate environment.

Now let’s consider how your clients are using bonds. If they are using bonds to meet income needs in retirement, they could face a dilemma. If their expenses go up, they may be compelled to sell their existing bonds in the secondary market at a reduced price, in order to achieve higher a yield.

Alternatives to fixed income investments include, Multi-Year Guaranteed Annuities, Income Annuities, Structured Products, Registered Index Linked Annuities (RILAs), and an option we highlight in What’s your favorite fixed income alternative? Fixed index annuities (FIAs).

FIAs contractually contain the following benefits:

Principal Protection – If the market goes down during the crediting method period, the contract value remains steady and fully protected.

Guaranteed Lifetime Income – Lifetime income riders can be added to FIAs that can last a lifetime or two.

Market Participation – When the market goes up over the crediting method period, the contract value of a FIA increased based off cap rates, participation rates. This means forward contract growth during positive market years and not taking losses during negative years.

Tax Deferral – In an FIA, the client only pays taxes when income is taken out, and this allows the money to grow in deferral.

Fixed index annuities fit in as an alternative to fixed income today due to the way they are designed to maximize value through annual reset. In bear markets, they take no losses, but when markets rally and recover from market dips, their growth helps to outpace inflation and provide additional benefits over fixed income investments. Talk to your clients who want to maximize their fixed income portion of their portfolio about your new favorite fixed income alternative.

To download the sales tool Click Here

To access WealthVest’s Suite of Fixed Index Annuity offerings fill out the form below:

*Franck, Thomas. “10-year Treasury yield hits new all-time low of 0.318% amid historic flight to bonds.” CNBC, March 8, 2020. https://www.cnbc.com/2020/03/09/10-year-treasury-yield-plunges.html.

When you buy a fixed index annuity, you own an insurance contract. You are not buying shares of any stock or index. This is not a comprehensive overview of all the relevant features and benefits of fixed index annuities. Before making a decision to purchase a particular product be sure to review all of the material details about the product and discuss the suitability of the product for your financial planning purposes with a qualified financial professional.

The annual reset allows for any interest credited on each contract anniversary to be “locked-in” and it can never be taken away due to market decreases. The interest credited is added to the accumulation value of your contract, which then becomes the guaranteed Accumulation Value “floor” that will be included in the calculation of the interest that is credited going forward, subject to any withdrawals and applicable rider fees.

The annual reset sets the index starting point each year at the contract anniversary. This reset feature is beneficial when the index experiences a severe downturn during any given year because not only do you not lose accumulation value from the downturn, but the new starting point for future growth calculations is the lower index value.

Although an external index may affect your interest credited, the contract does not directly participate in any equity investments. You are not buying shares in an index. The index value does not include the dividends paid on the equity investments underlying any equity index. These dividends are not reflected in the interest credited to your contract.

Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company and do not apply to the performance of the index, which will fluctuate with market conditions. Annuities are designed to meet long-term needs of retirement income. Annuity contracts typically require money being left in the annuity for a specified period of time, usually referred to as the surrender charge period. If you fully surrender your annuity contract at any time, guaranteed payments provided for in the contract and/or any rider will typically no longer be in force, and you will receive your contract’s cash surrender value. Before purchasing an annuity, read and understand the disclosure document for the early withdrawal charge schedule. The purchase of an annuity is an important financial decision. Talk to your financial professional to learn more about the risks and benefits of annuities.

Please note that in order to provide a recommendation to a client about the liquidation of a securities product, including those within an IRA, 401(k), or other retirement plan, to purchase a fixed or variable annuity or for other similar purposes, you must hold the proper securities registration and be currently affiliated with a broker/ dealer or registered investment advisor. If you are unsure whether or not the information you are providing to a client represents general guidance or a specific recommendation to liquidate a security, please contact the individual state securities department in the states in which you conduct business

KEY TERM FIXED INDEX ANNUITY (FIA):

A fixed index annuity (FIA) is a tax-deferred, long-term retirement savings vehicle issued by an insurance company. FIAs are designed to meet long-term needs for retirement income. While product and feature availability may vary by insurance carrier and state, in general, FIAs provide guarantees of premiums (backed by the financial strength and claims-paying ability of the issuing company), credited interest (subject to surrender charges), and a death benefit for beneficiaries. Any distributions may be subject to ordinary income taxes and if taken prior to age 59 1/2, an additional 10% federal tax. Early withdrawals may result in loss of the premium and credited interest due to surrender charges.

C1003 04/2/2020