Fed Cutting with Gold and Risk Assets Ripping

ISM Services Prices Paid suggest more upside to CPI

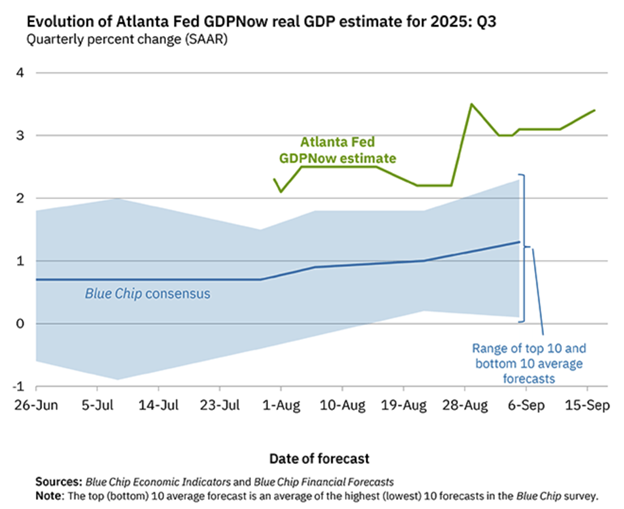

This morning the Atlanta Fed published their “Nowcast” for US economic growth in the third quarter. Historically, it has made sense to take these nowcasts with a grain of salt early in the quarter but later in the quarter, as we are now, these forecasts become more accurate. The message from the Atlanta Fed is clear: the demand picture in the US economy not only remains strong but may even be accelerating. Robust retail sales figures also released this morning show a consumer unphased by higher prices. Gold is breaking higher along with risk assets while the dollar is breaking down to three-year lows. In other words, the markets are telling the Fed and all market participants that there is a collective expectation of US fiscal policy makers (Congress and the President) ignoring deficits and monetary policy makers (the Federal reserve) continuing to ignore inflation.

Financial conditions are extremely accommodative. Credit spreads are tight and the wealth effect of stocks, rising home equity and even crypto are helping to fuel consumption among the top income (and top savings/investing) cohorts. Yes, the trend is negative in employment, but it has been for almost three years now. The large revisions to Non-Farm Payrolls don’t tell us that there is an inflection in unemployment, just the opposite. The reality is that job growth has been weak for some time but we now know that underlying wage growth and productivity are actually stronger than we thought.

Our view is that the overall economy is, while inexorably and profoundly bifurcating, strong and that the threat of inflation is much greater than the threat of recession. Overall, this is about as good a backdrop as you can get for risk assets: price momentum, an accommodative Fed, excessive fiscal spending, a benign credit environment and an administration that appears willing to break all traditional restraints when it comes to stimulating growth. The main risk we see to equities is that we see more dollar weakness that leads to a repeat of the foreign capital sell-off that we experienced this spring. Without explicitly saying that we are pursuing a weak dollar policy, our fiscal profligacy and monetary ambivalence to clearly accelerating inflation makes it is clear that is the case. In the immediate term, that is accommodative to growth but look at a weak dollar policy from the lens of a foreign investor. Are you going to be willing to risk further devaluation in order to own dollar denominated assets?

Markets love the money printing and “run it hot” mentality, but that is not to say there are not potential consequences longer term.

Tim Pierotti is WealthVest’s Chief Investment Strategist.

Tim has over 25 years of experience in various aspects of the equities business. Prior to joining WealthVest, Mr. Pierotti spent seven years in Equity Research management roles at Deutsche Bank and most recently at BMO where he was a Managing Director and Head of US Product Management. Tim has 11 years of investment experience most notably as Head of Consumer Research and Portfolio Manager at The Galleon Group, a former NY based $8Bln Long/Short hedge fund. Tim is a graduate of Boston College and lives in Summit NJ.

WealthVest makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made in this material, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of Tim as of the date indicated. They do not necessarily reflect the views and opinions of WealthVest and are subject to change at any time without notice. WealthVest does not have any responsibility to update this material to account for such changes. There can be no assurance that any trends discussed during this material will continue.

Statements made in this material are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed in this material, including consulting their tax, legal, accounting or other advisors about such information. WealthVest does not act for you and is not responsible for providing you with the protections afforded to its clients. This material does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by WealthVest.

Certain statements made in this material may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

The S&P 500® is a trademark of Standard & Poor’s Financial Services, LLC and its affiliates and for certain fixed index annuity contracts is licensed for use by the insurance company producer, and the related products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC or their affiliates, none of which make any representation regarding the advisability of purchasing such a product. WealthVest is not affiliated with, nor does it have a direct business relationship with Standard & Poors Financial Services, LLC.

Securities offered through Institutional Securities Corporation, FINRA/SIPC member. WealthVest is neither owned nor controlled by Institutional Securities Corporation, 3500 Oak Lawn Ave., Suite 400, Dallas, TX 75219.