Six Fed Cuts

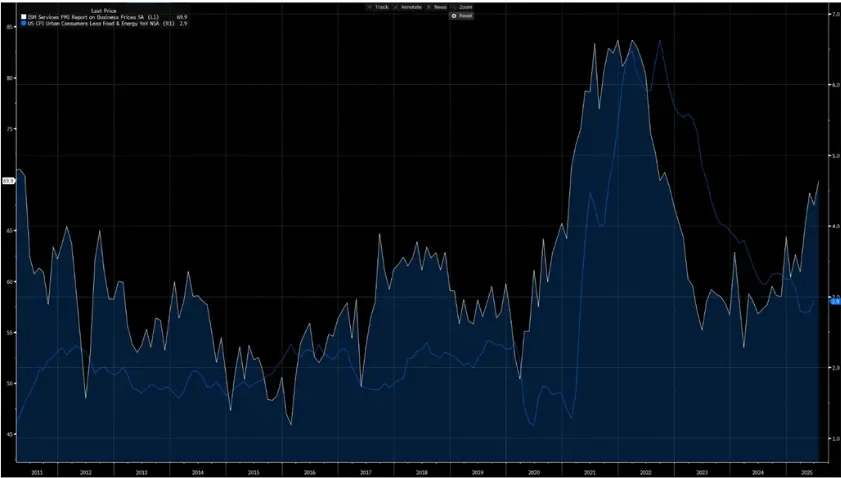

ISM Services Prices Paid suggest more upside to CPI

The Fed may well cut six times as bond markets are now pricing in. Earnings growth may accelerate as equities are pricing in. But the likelihood of getting both is pretty low and that is what gold and the US Dollar (trade weighted basket) are pricing in. Gold’s incessant strength and the dollar sliding through the lowest levels in three years are markets telling us that we Americans are losing our fiscal and monetary credibility.

In our view, 10% plus earnings growth over the next year is a more likely outcome than six Fed cuts. Second quarter earnings were solid and there was a notable lack of broad-based negative revisions as I and consensus opinion assumed. US based multi-national businesses are enjoying the benefit of the weaker dollar and strong global demand. There were no signs of an imminent recession from the NFIB (National Federation of Independent Businesses) this morning. Small business optimism grew slightly month over month. There is no sign of a slowdown in credit card data or other measures of consumer demand. Yes, there are pockets of weakness in the economy, especially amid the lower income cohorts but the top half of the economy which accounts for the vast majority of demand appears to be doing just fine. To be clear, our view is not that we are off to the races, but that the economy has been growing very slowly for a while now and that hasn’t prevented corporate earnings growth from outpacing the broader measures of demand.

The key factor that we think markets are missing is that demand for employment is weak, but so is the supply of labor. Why isn’t there a sharp rise in unemployment with such weak hiring? How is it that employment related taxes (FICA and Corp. withholding) grew 7% in 2025 amid such stagnant hiring? The answers respectively are the labor force is shrinking, and wage growth is running hot. The above chart shows that companies in service industries are seeing their costs rise. Most of that cost is labor.

Take the construction market as an example of an industry with rapidly shrinking demand for labor and still not enough labor. Today, the NFIB (National Federation of Independent Businesses) reported that half of all companies engaged in construction cannot fill open roles. That number is down from months ago but still tells a powerful story. Residential construction activity has fallen off the map. Commercial construction away from manufacturing has been soft for several years and even the torrid pace of the construction of manufacturing facilities has slowed and yet, there isn’t enough labor. Why? Partly, due to aging demographics which lead to more men over fifty leaving the labor force than there are young people entering it. But the reason also is deportations. It is estimated that as many as 50% of the workers in residential construction crews are undocumented. The mass deportation of those workers is going to tighten the construction labor market even when the number of homes being built is declining.

That brings us to the Fed. Since Powell’s surprisingly dovish speech at Jackson hole, equities are up, but bonds have absolutely ripped. The Chairman has, perhaps unwittingly, convinced market participants that employment is a far greater risk than inflation. Markets are now pricing in the Fed will cut three times this year and three times next year. That would take Fed Funds to 2.75%, which is below the current rate of inflation. Economists can debate how much Fed Funds should be above the rate of inflation but there are few credible economists who believe that the Fed should drive funds below the rate of inflation. Therefore, there is a collective forecast that inflation is ephemeral and poised to cool in the near future. The only way we could see the Fed cutting so much is if we are on the brink of a recession which would hit corporate profits and beget accelerating layoffs. While that is always a possibility, there are few signs of that developing currently. Obviously if that were to occur, the 10% earnings growth through next year would be off the table.

Our view is that the Fed and consensus opinion is misreading the weakness in payrolls, because they underestimate the impact of aging labor markets and deportations. We continue to see an economy that posts very slow real growth and inflation running well above the Fed’s target: mild stagflation. The Fed will cut next week for sure, but we will take the under - way under - on six cuts through next year. The strength of Gold and the dollar weakness reflect a collective sense that the Fed may be in the early days of a policy mistake. “Running it Hot” is great for risk assets in the near-term, but over the long-term risk is higher.

Tim Pierotti is WealthVest’s Chief Investment Strategist.

Tim has over 25 years of experience in various aspects of the equities business. Prior to joining WealthVest, Mr. Pierotti spent seven years in Equity Research management roles at Deutsche Bank and most recently at BMO where he was a Managing Director and Head of US Product Management. Tim has 11 years of investment experience most notably as Head of Consumer Research and Portfolio Manager at The Galleon Group, a former NY based $8Bln Long/Short hedge fund. Tim is a graduate of Boston College and lives in Summit NJ.

WealthVest makes no representation or warranty, expressed or implied, with respect to the accuracy, reasonableness, or completeness of any of the statements made in this material, including, but not limited to, statements obtained from third parties. Opinions, estimates and projections constitute the current judgment of Tim as of the date indicated. They do not necessarily reflect the views and opinions of WealthVest and are subject to change at any time without notice. WealthVest does not have any responsibility to update this material to account for such changes. There can be no assurance that any trends discussed during this material will continue.

Statements made in this material are not intended to provide, and should not be relied upon for, accounting, legal or tax advice and do not constitute an investment recommendation or investment advice. Investors should make an independent investigation of the information discussed in this material, including consulting their tax, legal, accounting or other advisors about such information. WealthVest does not act for you and is not responsible for providing you with the protections afforded to its clients. This material does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product or service, including interest in any investment product or fund or account managed or advised by WealthVest.

Certain statements made in this material may be “forward-looking” in nature. Due to various risks and uncertainties, actual events or results may differ materially from those reflected or contemplated in such forward-looking information. As such, undue reliance should not be placed on such statements. Forward-looking statements may be identified by the use of terminology including, but not limited to, “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology.

The S&P 500® is a trademark of Standard & Poor’s Financial Services, LLC and its affiliates and for certain fixed index annuity contracts is licensed for use by the insurance company producer, and the related products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC or their affiliates, none of which make any representation regarding the advisability of purchasing such a product. WealthVest is not affiliated with, nor does it have a direct business relationship with Standard & Poors Financial Services, LLC.

Securities offered through Institutional Securities Corporation, FINRA/SIPC member. WealthVest is neither owned nor controlled by Institutional Securities Corporation, 3500 Oak Lawn Ave., Suite 400, Dallas, TX 75219.